accumulated earnings tax irs

Section 531 for being profitable and not paying a sufficient level of dividends. Law on the subject.

Earnings And Profits Computation Case Study

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit.

. Deductions are allowed for federal income taxes paid excess profit taxes paid to foreign. Ad Taxes Can Be Complex. The government taxes accumulated earnings so as to prevent corporations from not paying dividends to its shareholders.

That the ac cumulation. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a. Internal Revenue Code of.

1 Accumulated taxable income is taxable income modified by adjustments in 535 b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535 c. Accumulated Earnings Tax Accumulated Taxable Income 20 Personal Holding Company Tax In times past the tax rate on individuals was considerably higher than on corporations. The accumulated earnings tax rate is 20.

1954 the Income Tax Regulations. The accumulated earnings tax is governed by Sections 531. Section 535 c 3 provides that in the case of a mere holding or investment company the accumulated earnings credit shall be the amount if any by which 150000 100000 in the case of taxable years beginning before January 1 1975 exceeds the accumulated earnings and profits of the corporation at the close of the preceding taxable year.

Exemption levels in the amounts of 250000 and 150000 depending on the company exist. As a practical matter the tax is col-. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable needs of the business for the purpose of avoiding income taxes on its stockholders.

Even though the tax rate on accumulated taxable income is 20 it would have risen to 396 thanks to the intervention of the American Taxpayer Relief Act ATRA that prevented it from rising to such a higher rate. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. Hence wealthy individuals formed holding companies specifically to hold investments so that the investment income would be taxed at the lower rate.

The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. 535 a Accumulated taxable income means the taxable income of the corporation MINUS ALL of the following. The adjustments include a deduction for federal income taxes paid.

How much is the accumulated earnings tax. Accumulated earnings penalty is accumulated taxable income. To 537 is extremely.

Internal Revenue Service IRS sets the accumulated earnings tax scheme to prevent companies from excessively accumulating their income and to pay dividends instead. Claim Your Earned Income Tax Credit And Search Hundreds Of Other Deductions. A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it has available to make dividend distributions.

Constitutes a fact which. Let TurboTax Find Every Deduction To Maximize Your Refund. Pursuant to 26 USC.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Accumulated Earnings Tax IRC. Dividends Paid In That.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. What is the Accumulated Earnings Tax. The IRS also allows certain exemptions based on the required need for the accumulated earnings.

Charitable contributions and any net. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. The reason why the IRS.

Dividends are taxed higher than capital. The Accumulated Earnings Tax is computed by. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior to 2013 of.

As indicated above if the capital accumulation is done for reasonable business needs the IRS might not issue the penalty. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted.

Click to see full answer. Liability for the accumulated earnings tax is based on the following two conditions. To the ambiguity surrounding what.

ACCUMULATED TAXABLE INCOME. Key Takeaways An accumulated earnings tax is a tax on retained earnings that are considered unreasonable which should be paid out as. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

Earnings And Profits Computation Case Study

Irs Use Of Accumulated Earnings Tax May Increase

What Are Accumulated Retained Earnings

Cares Act Implications On Corporate Earnings And Profits E P

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

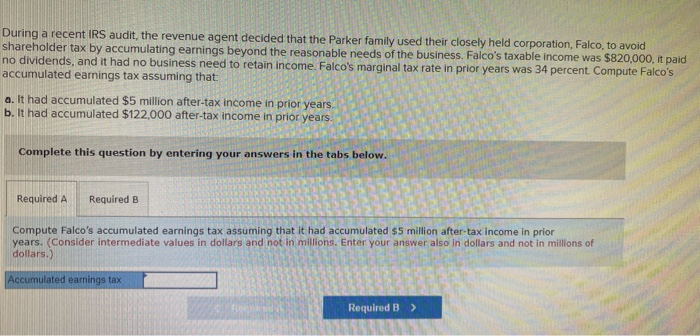

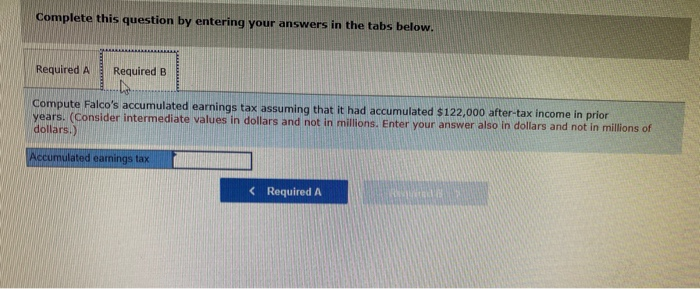

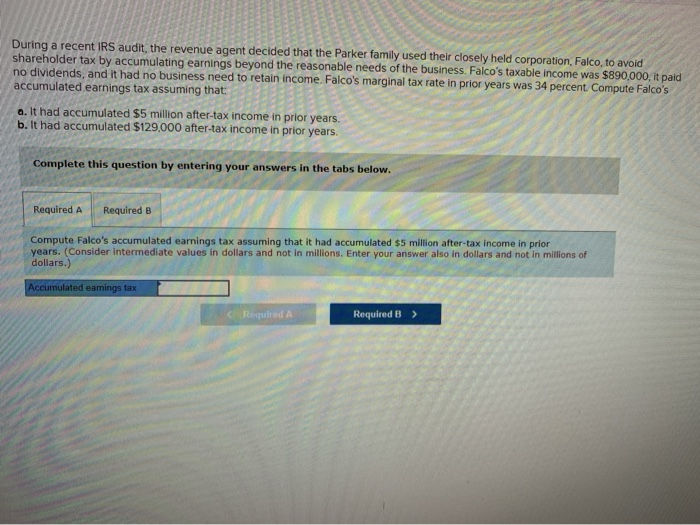

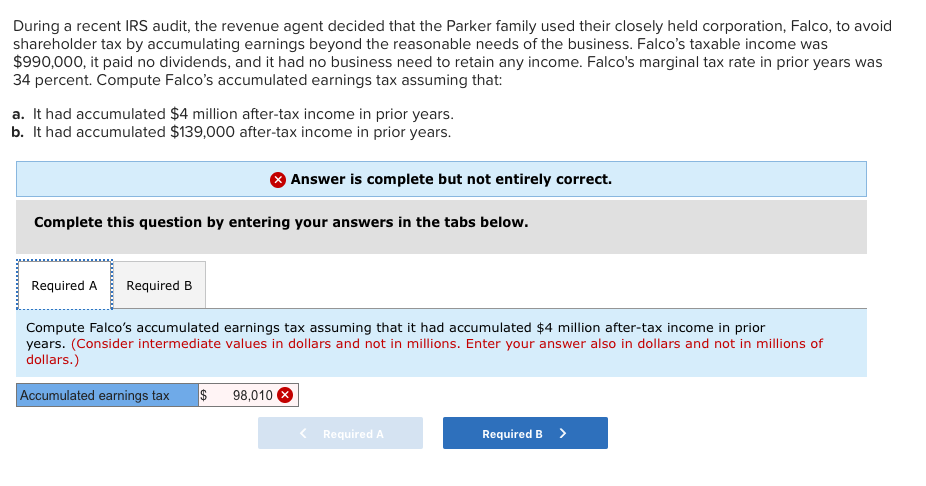

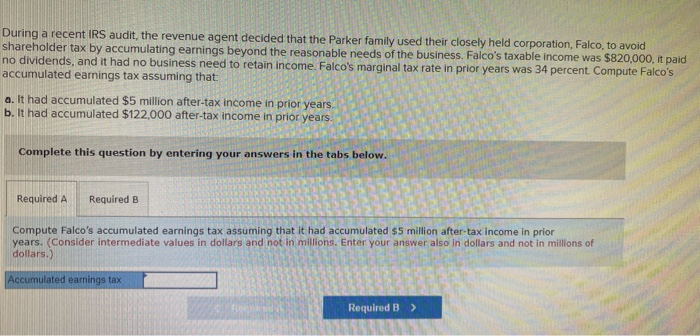

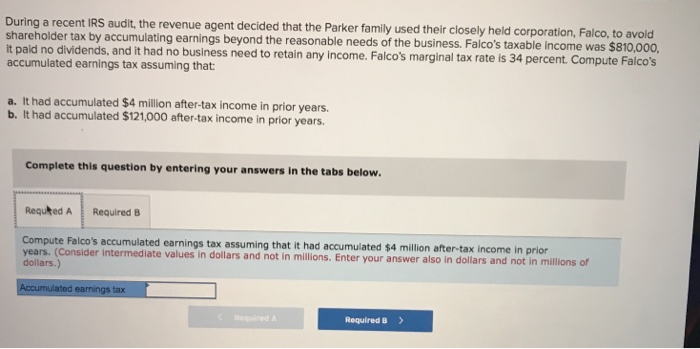

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Demystifying Irc Section 965 Math The Cpa Journal

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Solved Determine Whether The Following Statements About The Chegg Com

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com